Setting Up A Homestead Budget For One Small Income

We get it – you want to live a simple, low cost, and resourceful life as a homesteader or frugal minded person. Or, you simply don’t make much. This homestead budget guide will give you the practical examples and tools you need for living off one small income.

Why Keep a Budget?

Often when I’ve brought up budgeting in conversation, the thing that immediately comes to people’s mind is restraint. “I won’t be able to spend money the way I want to anymore.”

In college, a mentor sat down with me and explained his family’s simple method of keeping a budget and tracking their month-to-month finances.

“It’s not about restraint,” he explained, “It’s about freedom!” Not growing up with a framework for keeping a budget, this turned my perception of what it meant to have a budget on its head.

There’s the saying, “Failing to plan is planning to fail.”

A budget is simply a plan for your money. Without that plan, how do you know if you are moving toward your goals? How do you know if you have overspent? How do you know if you are being the best steward of your money?

We have experienced that “freedom” first hand in our life through keeping a budget. It has allowed us to spend in alignment with our goals and values, save when we needed to save, and live the life we want to live even on low income.

Our Budgeting Success Story

We have not had high paying jobs since getting married out of college 13 years ago.

The first 5 years were spent as campus missionaries making around $30,000/yr. The middle years were spent primarily with one of us working various low-middle income jobs while our family grew.

These last couple years we left what was our best paying job to pursue different opportunities in agriculture, start homesteading, and ultimately build our home-based business. Yep, still not making much!

Our key ingredient to success – BUDGETING!

We have kept a budget all 13 years of our marriage and our expenses have not exceeded our income. Even when income was low.

We set our budget around that $30,000/yr amount and held it there even when we were making more and during the season when both of us were working.

This allowed us to save, pay off debt aggressively, and move toward the financial freedom in our life that we were after. And our budget kept us unified in our personal finances – even during the hard times.

This unity and freedom is within reach! It might take some scrappiness and sacrifice. It might take rethinking some habits or expenses. But it’s totally worth it and totally possible with a well-planned budget.

Step By Step Guide to Set Up Your Budget

1. Know Your Goals and Values

A budget is simply a reflection of where you want to be and what defines you. Your goals and values.

If your goals and values are not currently clear, then it will require some processing with yourself, a spouse, partner, relative, or friend. A good goal would be to come up with either a list of the things that are most important to you, or some sentences or paragraphs that describe what characteristics define you and the short-term or long-term goals you want to achieve.

This acts as your mission statement. You can then use your mission statement as a filter or lens through which to view your personal finances.

Successful budgets start with this big picture in mind. Here’s a list of questions that you can use to bring clarity to your goals and values:

- How would others describe what is important to me?

- What is unique or significant about my past that I want to continue to be a part of my future?

- Are there areas of my life am I not currently satisfied with?

- What were my family’s top values growing up? Do I agree or disagree with those values?

- What gets me out of bed in the morning?

- Where do I see myself in 5 years? 10 years? Beyond that?

- What achievable goals will be most helpful to get me there?

2. Track Your Current Expenses

The next step is to understand your current spending per month. On a piece of paper or in a spreadsheet, record every dollar you spend and what the expense was.

Track those expenses for at least a month. A three-month period will give you a better understanding of your overall expenses. Whatever period you decide, make sure your expenses are tracked monthly so you gain a firm understanding of your month-to-month spending.

At the end of each week or month, use your list of current expenses as an opportunity to learn about yourself and your spending. The goal of doing this is not to feel guilty or ashamed. However, reviewing your spending will likely bring up areas to improve your habits or develop self-control.

Some questions to ask as you review your expense are:

- Was this purchase necessary?

- Are there ways I can purchase this item less often?

- Can I be more resourceful to reduce my need for this item?

- Could I have bought this second hand?

- Could I have bought a higher quality option that would cost more upfront but save money in the long run?

- Did that purchase meet my expectations? Could I make a better purchase next time?

- Do my purchases bring me long term joy, meaning, and value?

- Could I have cut back to reduce that cost?

- Was this an impulse buy or was it planned?

3. Establish Your Income Amount

Your monthly income will either be a set amount, or fluctuate month-by-month.

If a set amount, simply total up your paychecks per month and you have your income. Keep in mind, you may want to challenge yourself to set your budgeted income below what you are making. This can allow you to, A) save a percentage of your income toward a goal or forecasted expense, or B) not be caught off guard in the event of an unexpected expense, job transition, or reduction in pay.

Your pay may also be variable. One month you might have $4,000 of income, and the next month $6,000. In this case, I would encourage you consider setting your budgeted income at the lower end amount. In the above example, if you set your monthly income at $5,000 and have three months in a row of bringing in only $4,000, you will feel the strain on your wallet. If your budget is set at $4,000 of income and you bring in more than that, you have freedom in your finances to save or be ready for the unexpected.

Living off one small income can mean getting scrappy and challenging yourself to cut back. You need to cover your base expenses at a minimum. But setting your budgeted income level below your actual income is a great way to slim up your budget and save toward long-term goals.

4. Estimate Your Monthly/Annual Expenses

The current expenses you tracked from Step 2 will give you a head start in this step. But there are likely expenses you need to account for that did not pop up during your tracking period – insurance bills, property taxes, car registration fees. All of these expenses need to captured in your budget.

On an annual or monthly basis, you will have both fixed and variable costs.

Fixed costs will include expenses like:

- Rent/mortgage

- Phone/internet bills

- Health insurance premiums

Variable costs will include expense like:

- Gas

- Groceries

- Utilities

To build an effective budget that meets your needs and allows you to live off a small income, you will need to dial in your fixed costs and do your best to estimate your variable costs.

I recommend two things here:

1) Start somewhat conservative on estimating your expenses. Or, allow for wiggle room. For example, if your monthly gas expenses are regularly coming in around $250/mo., consider setting the gas category in your budget at $300/mo. so you are not caught off guard if your gas is higher in a given month.

2) Treat your variable costs like a fixed cost. If you regularly go out to eat and have a budget category for dining out set at $100/mo. then commit to yourself ahead of time stick to those parameters. Once you reach that $100/mo. limit for the month, you are done eating out that month.

This spreadsheet shows an example budget template with basic expense categories to use as a starting point. Your budget will be unique to your life situation, so add and subtract categories where needed.

5. Create Your Budgeting System

In the end, your overall budget will be your budgeted income minus your total expenses. Tracking your income and expenses month-to-month will be crucial.

Your budgeting system will need to be reliable. But that doesn’t mean it needs to be complex. You can use a sheet of paper, a spreadsheet, a budgeting app, or some combination.

The important thing is that every dollar is being tracked; every dollar in and every dollar out. These accurate records of your personal finances will be invaluable month to month to track the progress you are making to stick to your budget and move toward your goals.

Our Low Income Budget Example

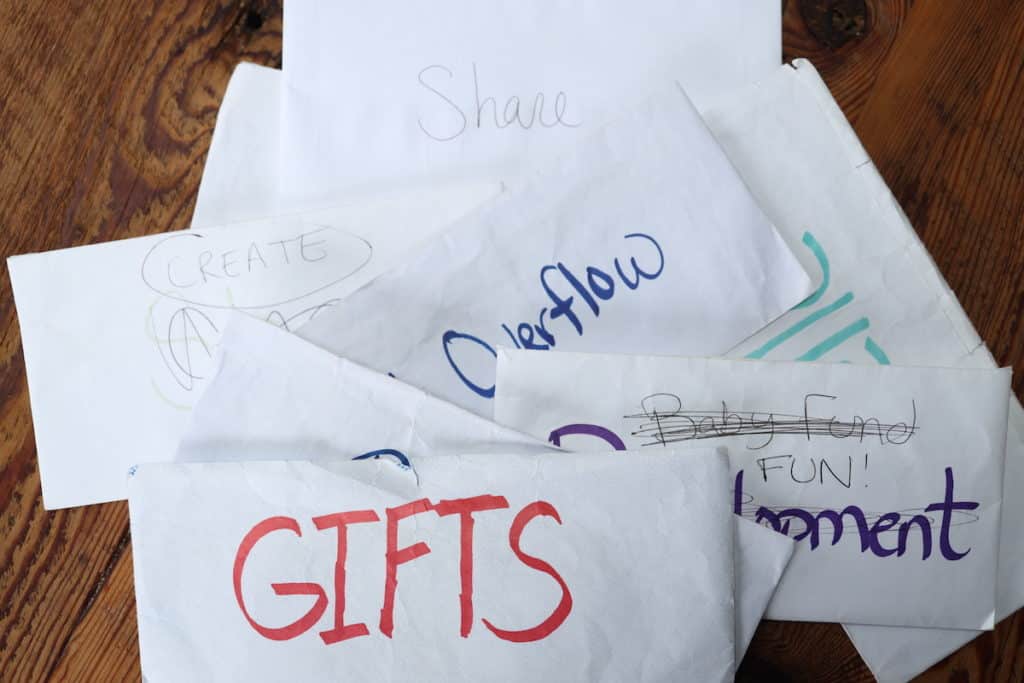

The system we use to budget is commonly called the envelope system. Categories like food, entertainment, gift, and miscellaneous household expenses each have their own envelopes that we fill with the budgeted amount of cash at the beginning of each month.

We don’t have an envelope for other categories we commonly pay by check, debit, or credit card. That money is kept in our checking account and we track it monthly in a spreadsheet.

The envelopes have worked great for us. We stretch our dollars to last the full month and know that when the money runs out, we are done spending in those categories. This has allowed us keep our cost of living very low and make sure our dollars are going toward purchases that are thought through and match with our values.

In the video below, we break down our full budget and how our family of 5 currently lives off of just over $30,000/yr.

Tips to Make Your Budget A Success

1. Everyone NEEDS To Be On Board

Your budget will only succeed if your spouse, partner, family are fully committed. This is why Step 1 is defining your goals and values and making sure everyone’s needs and concerns are addressed.

A budget is much more than numbers and a spreadsheet. It represents your hopes, dreams, and overall vision for your life. When someone steps outside the parameters a budget sets, not only can that crumble the budget, but also the trust between those committed to it.

If you are single, you don’t need to worry about anyone else not holding up to their end of the bargain. Except, yourself! The benefit of a spouse or partner is that there is built in accountability that someone who is single does not have. Consider asking someone trusted in your life to provide that accountability and check in regularly on the progress you are making.

2. Monthly Budget Reviews Are A MUST

At a minimum, you will need to sit down and balance out your budget once a month. Depending on the complexity of your life and spending, you may need to do this twice a month or even weekly.

The goal is to record each expense and make sure it is accounted for in your budget and income.

If unexpected expenses came up, you will need to figure out where that money is coming from. This can be difficult. It may mean taking from savings or an emergency fund. Or reducing budget categories in following months to make up for it.

This is why I recommend being conservative in your budget categories to start, which can give some wiggle room for areas you might overspend in occasionally. As your budgeting confidence and experience grows, then you can start dialing in categories to be more precise.

3. PLAN For An Annual Big Picture Budget Retreat

Tracking the month-to-month is huge. But sometimes, it takes a bit deeper dive to really grasp how your budget is going and how to improve it.

We have made a habit of scheduling a day or two each December to get away, free from distractions, and take a close look at how our budget did last year and what needs changing. Where did we overspend? Where did we underspend? Are there new categories we need for the upcoming year? Have our goals changed or are we wanting to save toward something? Were there areas of spending we felt didn’t align with our values?

These questions can be SO critical to making sure you are remaining committed to, and excited about your budget, and not just keeping it all on auto-pilot.

4. Have An Emergency Fund Or Savings ON HAND

A slim budget means margins can be tight. When unexpected things come up – car issues, trips to the ER, home repairs – you want to be prepared to go above and beyond what is budgeted.

The recommended amount for an emergency fund is typically 3-6 months of your income saved up. It is crucial this money be readily available for when emergencies do arise.

If you are new to budgeting and don’t have additional savings on hand for emergencies, I would recommend setting aside as much of your income as you can afford each month until that reserve savings is at an amount you feel comfortable with.

5. Invite OTHERS In

One of the biggest influences in our spending can come from those close to us – family, friends, neighbors. “Hey, we’re going to see that new movie – want to come with?” “We didn’t have anything planned for dinner tonight so we’re going out – want to join?” “What, you don’t have this latest subscription – you got to see this new show!”

I’m not making an argument for or against any of these things. But if they’re not planned for in your budget, these expenses quickly add up.

Have a conversation about your budget with the family and friends you spend the most time with ahead of time. Let them know your goals and that what you can afford to do might look different. The hope is that they will rally around you and encourage you along the way. Plus, it will take the pressure off to say “yes” to everything and give them context when you do turn something down.

6. Have FUN With It!

Setting a homestead budget will take some time to dial in and there will no doubt be difficulties that pop up. But have fun with it and celebrate when goals are reached along the way!

We often view our monthly budget reviews as somewhat of a date night. Each month you stick to your budget is worth celebrating and moves you toward where you want to be. And the annual retreat can be so much fun to really think back on the year and see all that you were able to achieve and dream big for the upcoming year.

Final Budget Thoughts

If I can leave you with a few final thoughts, they’d be:

- You don’t have to spend a lot of money to be happy and live richly.

- Living within your means is not about restraint, but freedom.

- Your budget is a reflection of your goals and values.

Keeping to any budget takes grit and determination. Let alone one that is based on a small income. But the end result is worth it.

We’ve seen this to be true in our lives and know it can be true in yours!

But what questions do you still have or what help do you need to get your budget off the ground? We’d love to hear from you in the comments below!

And if you’re looking for more helpful tips on living a low-cost lifestyle, check out our post 14 Frugal Homestead Ideas gives our best tips for reducing costs while still maintaining a high quality of life.

Pin it for later!